Creditworthiness or credit score is an odd concept. Its purpose is to monitor our financial and debt history. Even though it seems normal to most inhabitants of the Western World it has only existed for about 200 years. Creditworthiness measures an individual’s ability to repay a loan by looking at their financial history. For example a person with a stable job, high income and a good credit history is more likely to have their loan approved, whereas a person that has an unstable job, low income and a bad credit history is less likely to be approved.

For most of debt history credit reporting has been a personal practice, most individuals would ask friends to vouch for their character to the banks. But in the 1820s credit reporting began to modernize as banks were becoming more important because of colonial ventures and globalization. The old system didn’t work anymore as transactions and loans were increasing in quantity and importance. In 1841 the Mercantile agency founded by Lewis Tappan, burned down during the panic of 1837 due to merchants over-extension of credit. Tappan set out to regularize rumors regardings debtors’ character and assets. Many of these early reports were incredibly racist, sexist and anti-sematic. They reinforced social hierarchy, becoming an early form of redlining. Later it became a sort of “financial identity”, it summarized one’s financial history.

( sources: Time and Wikipedia )

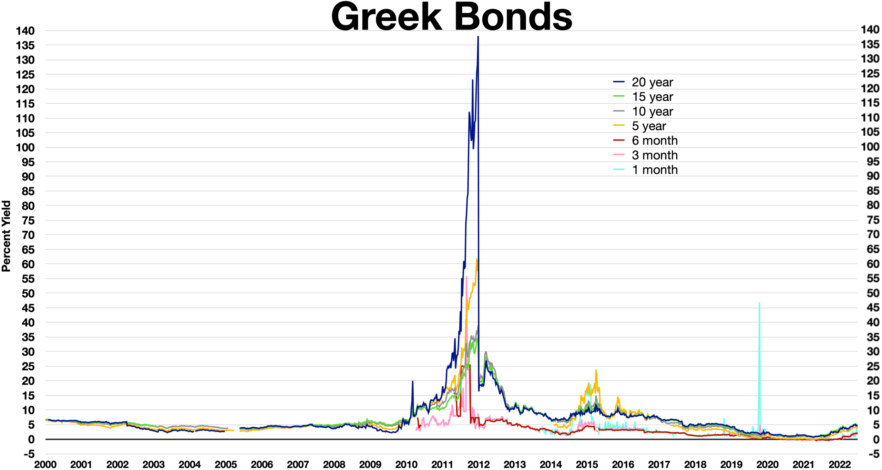

A good example of bad credit rating is the Greek State. Greece was less productive then than other European nations, and Greek goods and services were less competitive. Ever since after World War I Greece has had financial problems. During the 1930s the Greek State owed money to the British, the French and the Italians. Before 2001 Greece experienced high inflation, high fiscal and trade deficits, low growth and currency problems. The only way Greece was able to join the Eurozone was by misrepresenting its financial situation. The crisis lasted from 2008 to 2018 because of the dangerous sum that the Greek state owed the EU. By 2010 Greece notified the European Union that it might default on its debt. In order to avoid this, the EU lent Greece just enough money to continue making it by. The Greek government was thus obliged to implement austerity measures. It is considered the biggest financial rescue of a bankrupt nation in History, Greece is expected to continue repaying its debt until around 2060.

( sources: The Balance and Wikipedia )

We can see that the Greek debt crisis started when the Greek State was given a bad credit rating, so the importance of Creditworthiness in the 21st century is not to be underestimated. Keeping a positive Credit Rating is very important.

Further Reading:

By Laird Balas

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License, unless otherwise licensed by original authors.